Piketty's immaculate research establishes that the American dream – and more broadly, the egalitarian promise of Western-style capitalism – does not, and maybe cannot, deliver on its promises. Photo: Ed Alcock for the Observer

Piketty's immaculate research establishes that the American dream – and more broadly, the egalitarian promise of Western-style capitalism – does not, and maybe cannot, deliver on its promises. Photo: Ed Alcock for the ObserverWhen the movie is made about the fall of Western capitalism, Thomas Piketty will be played by Colin Firth. Piketty, whom the Financial Times called a "rock-star economist", isn't a household name – but he should be, and he has a better shot than any other economist. He is the author and researcher behind a 700-page economic manifesto, titled Capital in the 21st Century, that details the path of income inequality over several hundred years.

This sublime nerdishness is, somehow, a huge hit. It is now No 1

on Amazon's bestseller listand sold out in many bookstores. When Piketty spoke on a panel this month at New York's CUNY with three other economists – two of them Nobel-prize winners, Joseph Stiglitz and Paul Krugman – the Frenchman was the headliner. The event was so packed that the organizers had to create three overflow rooms. Weeks after the release of Capital, intellectuals are still salivating, even calling Piketty

the new de Tocqueville.

This is quite a burst of stardom for a man who, despite his understated Gallic charm, is very much the bearer of bad news. Piketty's sublimely nerdy book, packed with graphs, statistics and history, is all evidence for an immensely depressing theory: that the meritocracy of capitalism

is a big, fat lie.

Piketty's research, which is immaculate, reaches back hundreds of years to establish a simple thesis: the American dream – and more broadly, the egalitarian promise of Western-style capitalism – does not, and maybe cannot, deliver on its promises. That, he writes, is because economic growth will always be smaller than the profits from any money that is invested. Economic growth is what we all benefit from, but profits from invested money accrue only to the rich.

The consequences of this are clear: those who have family fortunes are the winners, and everyone else doesn't have much of a shot of being wealthy unless they marry into or inherit money. It's Jane Austen all over again, and we've just fooled ourselves that the complicated financial system has changed a thing.

This is a deep point. Many American households, if they are lucky, will grow their wealth at the same rate as the economy. But, because the wealthy are growing their fortunes at a much faster rate, no one else can ever catch up.

Let's repeat that: no one else can ever catch up.

This is where Piketty adds more nuance: it's not just inequality of wealth and income that we're struggling with, but inequality of opportunity. That's of far more concern. In essence, he is saying, we're lying to ourselves if we believe that hard work will lead to wealth. Mainly, wealth reliably leads to wealth. Everything else is chancy. The middle class is playing the economic lottery to improve their lot in life, while the wealthy have a sure thing.

This is clearly fraught – and to some, like theNew York Times columnist David Brooks,

it sounds like class war (he calls it "angry progressivism"). Piketty's purpose is not to point out that inequality exists, or that it's growing – both of which have been established ad nauseum by everyone from President Obama to Pope Francis. Piketty's point is that we are actually doomed to inequality.

It's hard to argue with this, really – Piketty's research is too good, too sprawling, too complete. It's as good as fact. It codifies what many suspected. Piketty's point is accepted wisdom in most of Europe, where, in France and Germany, the

morality of capitalism is regularly questioned.

But there remains a lot of controversy anyway. Why? Because Piketty wants to change the lever on income inequality by putting a tax on wealth – not on income, which is the stuff of the middle class, but on fortunes themselves, on the money that is invested and reinvested and compounded and grown.

You can see the problem. Whereas many progressives believe Piketty is the economic Messiah they've been waiting for, many on the right loathe where this is going. They've successfully fought tax hikes for years, especially on the estates of the wealthy (Grover Norquist built his career on it). One struggles to sympathize: the wealthy, like corporations, rarely pay the full burden of tax anyway. The biggest barrier they face is that good accountants are hard to find.

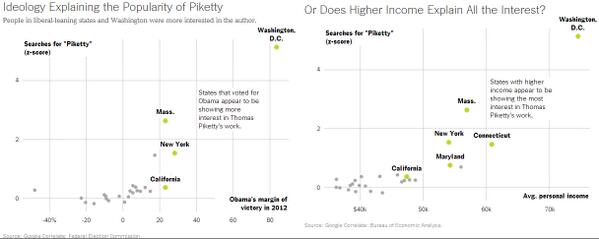

All of this must seem familiar, and that's a good thing. Piketty's book, and his charismatic sweep through the pundit classes, are crystallizing a conversation that America should have already had, seriously, a long time time ago. There are two ways to change a society: from the bottom, and from the top. Occupy Wall Street tried it the first way, and paved the road with populism. Thomas Piketty is going for the second way. He has roiled the pundit classes – as Brookings economist Justin Wolfers observed, Piketty's biggest readers are in New York and Washington DC:

That's a limited scope, though, and Piketty isn't looking for endorsements. He's looking for action. This is why it's important that the conversation about him extends beyond the sniping of pundits wrapped up in their own agendas and their own speaking fees.

Piketty has to do what no one else has yet: win over regular citizens, who have long heard patronizing speeches about inequality but seen very little political action. Piketty's goal is as ambitious as his research – to change the way wealth is distributed. So far, it's a message that a lot of people like to talk about, but very few want to hear.

No comments:

Post a Comment